shanszavod.ru

Tools

I Need 5 Million Dollars Now

today's dollar in the future. For instance, $ that you How much money would you need in 20 years to maintain the same purchasing power as today? Multiple Listing Service (MLS) Website: 5%; Other website with real estate listings: 1%; Video hosting websites: 1%. Most difficult tasks for FSBO sellers. This financial calculator helps you find out. Enter in the current savings plan and graphically view the financial results for each year until you retire. need to end with $9,, in order today. $, dollars in , $, dollars today. $1,, dollars in , $1,, dollars today. Here are five effective ways you can start earning money online today. 1. Freelance Writing: Freelance writing is a rapidly growing field that. This calculation presents potential savings plans based on desired savings at retirement. Your age now. Your planned retirement age. Amount needed at the. $5,, in is equivalent in purchasing power to about $,, today, an increase of $,, over years. The dollar had an average. Current investment needed for future value · Enter a dollar value you want your investment to attain in the future. · Click Calculate. If you want to succeed in a business that lets you earn your first million, you need to build credibility, which is a long-term and continuous engagement. today's dollar in the future. For instance, $ that you How much money would you need in 20 years to maintain the same purchasing power as today? Multiple Listing Service (MLS) Website: 5%; Other website with real estate listings: 1%; Video hosting websites: 1%. Most difficult tasks for FSBO sellers. This financial calculator helps you find out. Enter in the current savings plan and graphically view the financial results for each year until you retire. need to end with $9,, in order today. $, dollars in , $, dollars today. $1,, dollars in , $1,, dollars today. Here are five effective ways you can start earning money online today. 1. Freelance Writing: Freelance writing is a rapidly growing field that. This calculation presents potential savings plans based on desired savings at retirement. Your age now. Your planned retirement age. Amount needed at the. $5,, in is equivalent in purchasing power to about $,, today, an increase of $,, over years. The dollar had an average. Current investment needed for future value · Enter a dollar value you want your investment to attain in the future. · Click Calculate. If you want to succeed in a business that lets you earn your first million, you need to build credibility, which is a long-term and continuous engagement.

Between and , more than 1 million additional direct care workers will be needed to care for the growing population of people living with dementia — the. For example, if you started with $5,,, you would need $38, dollars today. $1, dollars in , $76, dollars today. $5, dollars in There are now 7 million fewer people in poverty than there were in It also created the Children's Health Insurance Program to serve up to 5 million. IRS helps taxpayers by providing penalty relief on nearly 5 million 20tax returns with unpaid balances now have until Oct. 7, , to file. The six steps to making a million dollars include finding extra income through starting a side hustle online, a second job, or investing in yourself by learning. Buy a small and nice cheap apartment, buy basic necessities (some clothes, art equipment and maybe a bike), save a bit of money in the bank for. million deaths in - 1 every 5 seconds. Diabetes caused at least USD billion dollars in health expenditure – a % increase over the last 15 years. For example, if you started with $5,,, you would need This conversion table shows various other amounts in today's dollars, based on the %. calculator estimates your retirement savings based on your current contributions, and then calculates how your savings will stretch in today's dollars. Use our inflation calculator to check how prices in the UK have changed over time, from to now. Our inflation calculator is designed for illustrative. Today on this solo round of The School of Greatness, I'll tell you how I made a million dollars online (and how you can too!). I think this article is sadly right on the money. I thought for years that I'd be set once I crossed million dollar nw mark. Nope. My wife and I are now close. It can be interpreted as how much money you would need today to buy an item five million. GDP per capita and GDP are and times larger in. The IEA estimates that the transition towards net-zero emissions will lead to an overall increase in energy sector jobs: while about 5 million jobs in fossil. What's a dollar worth? How far does a past dollar stretch to equal the modern dollar? What would past prices be today February 5, Article. Federal. How much do you need to retire right now? $1 million or less; $2 million; $3 million; $5 million. Immerse yourself in Jackson Hole's iconic Million Dollar Cowboy Bar, where you will get Western history, cocktails, delicious food and live entertainment. To specifically reach a million bucks, you'll need to boost your savings “Additionally, by investing your money now and letting it grow, you'll be. There are now more than million millionaires in the United States. For starters, it is very important to distinguish between making a million dollars and. Million Deal is brain puzzle game that you play with money. You have a chance to win up to 1 million dollars. Amazing!!! GAMEPLAY.

How To Raise Credit Score In 1 Month

1. **Pay Down Balances**: Reducing credit card balances can quickly improve your credit utilization ratio. · 2. **Correct Errors**: Dispute and. 1. Request a Copy of Your Credit Report · 2. Pay Off All Outstanding Collections · 3. Make All Future Payments On Time · 4. Reduce the Balances on Your Credit. Here's how to build credit fast: Use strategies like paying off a high credit card balance, disputing credit report errors or asking for a credit limit. Making credit card payments on time is crucial to building credit, but don't forget your other bills. It's just as important to make sure all your monthly bills. Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save money · Consider a debt. It may seem obvious, but a history of consistent on-time payments is one of the biggest factors in building a good score. Thirty-five percent of your FICO®. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. Become an authorized user. Your credit score might be able to benefit from someone else's good credit history. When a loved one adds you to an existing credit. FICO says paying down your overall debt is one of the most effective ways to boost your score. If you are shopping for a mortgage, a car loan or a credit. 1. **Pay Down Balances**: Reducing credit card balances can quickly improve your credit utilization ratio. · 2. **Correct Errors**: Dispute and. 1. Request a Copy of Your Credit Report · 2. Pay Off All Outstanding Collections · 3. Make All Future Payments On Time · 4. Reduce the Balances on Your Credit. Here's how to build credit fast: Use strategies like paying off a high credit card balance, disputing credit report errors or asking for a credit limit. Making credit card payments on time is crucial to building credit, but don't forget your other bills. It's just as important to make sure all your monthly bills. Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save money · Consider a debt. It may seem obvious, but a history of consistent on-time payments is one of the biggest factors in building a good score. Thirty-five percent of your FICO®. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. Become an authorized user. Your credit score might be able to benefit from someone else's good credit history. When a loved one adds you to an existing credit. FICO says paying down your overall debt is one of the most effective ways to boost your score. If you are shopping for a mortgage, a car loan or a credit.

How to improve your credit scores · Make on-time payments every month. You can set up automatic payments or electronic reminders to help you remember due dates. 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. · 4. Be cautious about new loan applications · 6. Developing smart spending and saving habits are crucial to rebuilding your credit score, and one of the best ways to do this is to create a budget that. Pay your minimum balance on time · Have the right number of credit cards · Try to have different types of accounts · Increase your credit limit · Pay off your debt. What actions you can take to boost your credit scores? · Review your credit reports for errors and dispute any inaccuracies. · Keep paying your bills on time. Opening more credit accounts is a great way to improve your credit score over a couple of months because it doesn't require a large chunk of money upfront. If you've been managing credit for a short time, don't open a lot of new accounts too rapidly. New accounts will lower your average account age, which will have. 10 strategies that could improve your credit score in 30 days · 1. Make sure your credit report is accurate · 2. Check your credit score regularly · 3. Pay. One strategy some people use to improve their payment history is to take out a credit card that is easier to qualify for, like a gas station or store card, and. 10 strategies that could improve your credit score in 30 days · 1. Make sure your credit report is accurate · 2. Check your credit score regularly · 3. Pay. For most people, increasing a credit score by points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don'. You can also phone your credit card company and ask for a credit increase, and this shouldn't take more than an hour. Don't close old credit card accounts or. We'll look through 2 years of payment history for any qualifying bills that have at least 3 payments in the last 6 months (including 1 payment within the last 3. One must also make sure to practice healthy spending behaviors like responsible budgeting and monitoring your credit utilization ratio. 1. Review Your Credit. 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New Credit · 5. Consider Keeping Old. Discover and Capital One offer good secured credit cards. Use the card no more than once per month, and pay off the balance every month. If your. They help improve your credit score, reduce the amount you pay for the money you borrow and put more money in your pocket to save and invest. 1 Scores and. The first step to rebuilding credit quickly is to download a copy of your credit report. You can download it for FREE from Borrowell!. Once you understand. Experian Boost will automatically search for bills that have at least three on-time payments in the last six months, then add those to your credit file. 2. Because of that making at least your minimum payments on time every month is very important. Paying on time is a key part of your credit score and consistent on.

Flexible Spending Companies

An FSA offers your clients a smart way to help employees plan for health care costs and save money on their taxes at the same time. Employers benefit too, with. A flexible spending account, or FSA, is an employer-sponsored benefit that allows participants to set aside pre-tax funds from their paychecks. WageWorks takes work off your desk—managing Consumer-Directed Benefits (HSA, FSA, HRA, COBRA and other lifestyle employee benefits) in one place. An FSA is an account funded by both employers and employees for medical expenses, dependent care, adoption assistance, or commuter benefits. An HSA is a. Flexible Spending Accounts save you money on medical and child care expenses. Most people save at least 25% on each dollar that is set aside in the program. A flexible spending account (FSA) is an employer-sponsored benefit employees use to pay for approved health and dependent care costs. Flexible Spending Account (FSA) FSAs let you take money from your paycheck, before it's taxed, to pay for eligible healthcare and dependent daycare expenses. A flexible spending account (FSA) is a benefit that offers money-saving, tax-advantaged funds for participants to use on their everyday health and dependent. Flexible Spending Account (FSA) Benefits From Paychex. Offer a Paychex FSA to your workforce to enhance your health benefits and provide mutual tax savings. An FSA offers your clients a smart way to help employees plan for health care costs and save money on their taxes at the same time. Employers benefit too, with. A flexible spending account, or FSA, is an employer-sponsored benefit that allows participants to set aside pre-tax funds from their paychecks. WageWorks takes work off your desk—managing Consumer-Directed Benefits (HSA, FSA, HRA, COBRA and other lifestyle employee benefits) in one place. An FSA is an account funded by both employers and employees for medical expenses, dependent care, adoption assistance, or commuter benefits. An HSA is a. Flexible Spending Accounts save you money on medical and child care expenses. Most people save at least 25% on each dollar that is set aside in the program. A flexible spending account (FSA) is an employer-sponsored benefit employees use to pay for approved health and dependent care costs. Flexible Spending Account (FSA) FSAs let you take money from your paycheck, before it's taxed, to pay for eligible healthcare and dependent daycare expenses. A flexible spending account (FSA) is a benefit that offers money-saving, tax-advantaged funds for participants to use on their everyday health and dependent. Flexible Spending Account (FSA) Benefits From Paychex. Offer a Paychex FSA to your workforce to enhance your health benefits and provide mutual tax savings.

Offering a health care flexible spending account (FSA) lets you exempt your employees' FSA contributions from your payroll taxes and give employees another. A Flexible Spending Account or FSA is a tax-advantaged benefit program established by an employer for their employees. This consumer driven account allows. Employers also can contribute to employees' FSAs. Distributions from the account must be used to reimburse the employee for qualified expenses related to. A healthcare flexible spending account (FSA) is part of a benefits package that lets you use pre-tax dollars to pay for eligible health care expenses. The Optum Financial FSA includes a debit Mastercard, a fast and convenient way for employees to pay for eligible medical expenses. Learn more. The FSA Store carries over + guaranteed FSA-eligible products, health essentials, and more. A Healthcare Flexible Spending Account (HC-FSA) is an employer-sponsored account letting employees set aside pre-tax dollars to pay for eligible healthcare. Lively's Flexible Spending Account suite combines innovation, customer support, and easy-to-use-technology to increase employee adoption and simplify. Top Companies Offering Flexible Spending Account (FSA) (3,) · Tulip · System1 · Remitly · Calm · Benchling · Intelsat · Laudio · AffiniPay. Fintech • Legal. A Flexible Spending Account is an employee benefit that allows you to set aside money from your paycheck, pre-tax, to pay for healthcare and dependent care. Compare Flexible Benefit Plan Administrators to oversee the implementation and management of your organization's Flexible Spending Account (FSA) benefit plan. FSAs allow employees to pay for certain medical and dependent care expenses through pre-tax payroll deductions, which provides up to 40% tax savings for. Medical FSA: A medical FSA covers general-purpose health expenses and can be used for qualified expenses such as prescription drugs, insurance copayments and. FSAFEDS allows you to save money for health care expenses with a Health Care or Limited Expense Health Care FSA. Think of it as a savings account. If you have a health plan through an employer, a flexible spending account (FSA) is a tool offered by many employers as part of their overall benefits. A Healthcare Flexible Spending Account (FSA) is a personal expense account that works with an employer's health plan, allowing employees to set aside a portion. An FSA is an account offered by an employer, to which employees can contribute pre-tax dollars from their paycheck in order to pay for medical care, supplies. The most common type of flexible spending account, the medical expense FSA (also medical FSA or health FSA), is similar to a health savings account (HSA) or a. Flexible Spending Accounts, administered by WEX, offer a smart way to stretch your dollars by setting aside pre-tax funds to pay for eligible healthcare and. A flexible spending account (FSA) is a tax-advantaged account that can help you save on medical and dependent-care expenses. Learn how an FSA works.

Guarantee Life Annuity

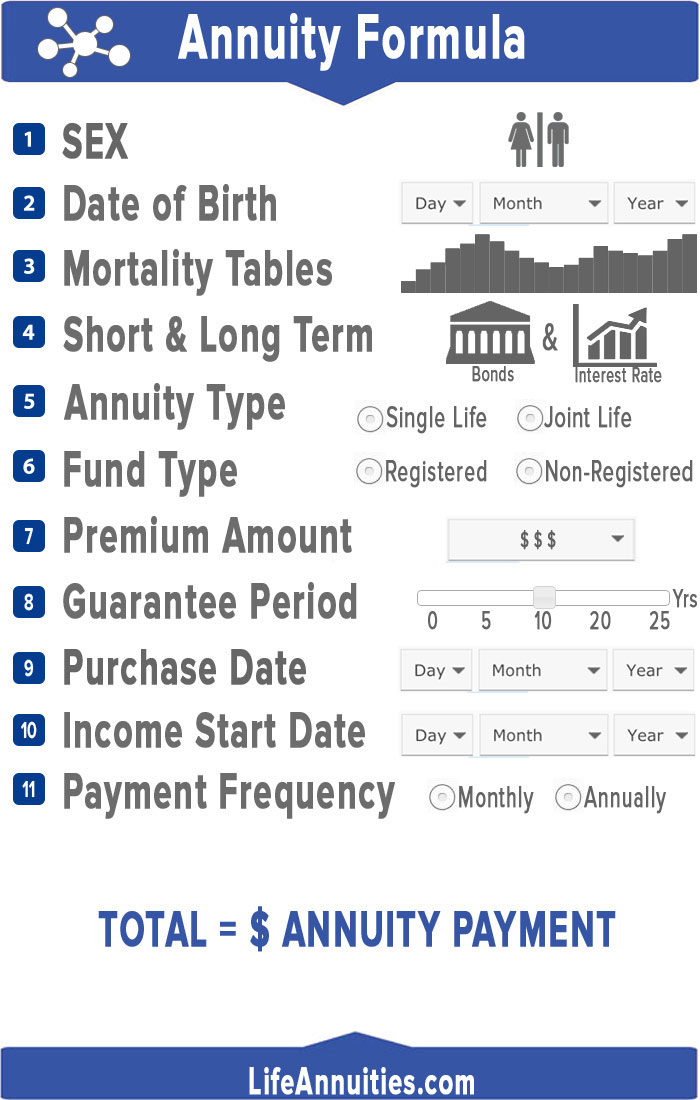

Annuities, a type of retirement investment that can be used to provide guaranteed income for life, can help with all of those risks. A life annuity provides a guaranteed income until you die, irrespective of the age you reach. The term on a life annuity determines the minimum years of. F&G offers life insurance and annuities to help you plan and protect your future. We value collaboration, authenticity, dynamics and empowerment. More than million Americans rely on Allianz Life Insurance Company of North America (Allianz) to help them achieve their financial and retirement goals with. Pacific Life offers a variety of annuities designed to help grow, protect, and manage retirement savings turning it into steady, reliable lifetime income. Nassau MYAnnuity 5X,7X is a single-premium, multi-year guaranteed annuity that offers you protection from market volatility, a choice of 5 or 7 year. Choosing a guaranteed period for a life annuity or joint life annuity ensures we'll pay a death benefit if income has started and the annuitant or both. A life annuity provides guaranteed income payments for as long as you live. A joint life annuity provides payments as long as you or your spouse/partner lives. It's a contract with an insurance company to turn your savings into a guaranteed stream of payments that lasts a set number of years, or even the rest of your. Annuities, a type of retirement investment that can be used to provide guaranteed income for life, can help with all of those risks. A life annuity provides a guaranteed income until you die, irrespective of the age you reach. The term on a life annuity determines the minimum years of. F&G offers life insurance and annuities to help you plan and protect your future. We value collaboration, authenticity, dynamics and empowerment. More than million Americans rely on Allianz Life Insurance Company of North America (Allianz) to help them achieve their financial and retirement goals with. Pacific Life offers a variety of annuities designed to help grow, protect, and manage retirement savings turning it into steady, reliable lifetime income. Nassau MYAnnuity 5X,7X is a single-premium, multi-year guaranteed annuity that offers you protection from market volatility, a choice of 5 or 7 year. Choosing a guaranteed period for a life annuity or joint life annuity ensures we'll pay a death benefit if income has started and the annuitant or both. A life annuity provides guaranteed income payments for as long as you live. A joint life annuity provides payments as long as you or your spouse/partner lives. It's a contract with an insurance company to turn your savings into a guaranteed stream of payments that lasts a set number of years, or even the rest of your.

Fixed annuities guarantee a minimum rate of interest while you save and, if you choose lifetime income, a minimum monthly amount in retirement. Converting some. Our Immediate Annuity is a simple annuity that you purchase with a single lump-sum payment. · This annuity then pays you a guaranteed income stream that can. Guaranteed Lifetime Income Rider is Rider Form Number and and is underwritten by Life Insurance Company of the Southwest, a member of National Life. It can help you protect and grow your retirement nest egg, or you can turn it into guaranteed lifetime income. You pay a premium (think of it as your. Guaranteed income annuities can provide lifetime cash flow in retirement that covers essential and other expenses and isn't vulnerable to market ups and. Life annuities with period certain let you choose to receive monthly payouts for life but hedge your bet by adding a period of time that the insurance company. Life Annuities – An Annuity That Guarantees a Lifetime Income If you are retired or nearing retirement, a life annuity should be a retirement income strategy. The basic form Guaranteed Lifetime Income Annuity has a guarantee period of 10 years that starts from the date of your first monthly income payment. Should you. GUARANTEED INCOME ANNUITY Download Our Brochure The Guaranteed Income Annuity was designed to help retirees plan for a more secure financial future for. Taxes. Annuity contracts provide certain tax advantages. Income taxes on interest and investment earnings in deferred annuities are deferred. However, in. Serving individuals and families in 49 states and the District of Columbia. We offer competitive health, accident, life and special risk insurance programs. Rather, it's an income product that provides you with fixed monthly income that is guaranteed for life, no matter how the markets perform. The total payout you. The SPIA provides guaranteed income (your "retirement paycheck") that will continue for the rest of your life, and—if you choose a joint life option—for the. Annuities offer guaranteed lifetime income, can reduce risk within your portfolio, help you save more for retirement, minimize taxes and provide legacy. The company will guarantee it will not change Replacement occurs when a person purchases new life insurance or an annuity and the person's existing life. What annuities does USAA offer? ; Fixed Indexed Annuity · Minimum to open: $,; Term: 7 years; Growth opportunity based on the S&P ® ; Deferred Annuity. Annuities are one of the few sources of retirement income that can guarantee1 income for life. So no matter how you envision retirement, having the freedom. Allianz Life offers annuities, life insurance, and Buffered ETFs that can help you manage risks to your retirement security. A living annuity is a market-linked investment that gives pensioners a regular retirement income while at the same time aiming to grow their retirement savings. Guaranteed income for retirement. Fixed income annuities turn your contributions into a steady stream of guaranteed retirement income — for your lifetime or a.

Digital Copy Writing

Learn how to become a digital nomad copywriter, so you can get paid to travel. Even if you don't know what copywriting is. Digital Copywriter delivers resources and training for digital copywriters. Find fulfilling career guidance to grow your digital copywriting business. A digital copywriter produces online content optimized for search engines and people. They create different types of content for any online project, such as. Kickstart your copywriting career with Iraqi Innovators! Specially designed for Arabic-speaking beginner writers in Iraq. Digital copywriting means crafting content for online audiences. This includes writing product pages for eCommerce websites, articles for blogs and news sites. As a digital copywriter (or digital content writer), you'll produce the written content for webpages, either working in an employed position or as a freelancer. Digital Copywriter delivers resources and training for digital copywriters. Find fulfilling career guidance to grow your digital copywriting business. Learn how to write copy for digital channels and consistently produce copy that builds your brand and gets results. Digital writing is different in two key ways: length and approach. Longer lead times to create copy with a longer shelf life; whether it's website copy, blogs. Learn how to become a digital nomad copywriter, so you can get paid to travel. Even if you don't know what copywriting is. Digital Copywriter delivers resources and training for digital copywriters. Find fulfilling career guidance to grow your digital copywriting business. A digital copywriter produces online content optimized for search engines and people. They create different types of content for any online project, such as. Kickstart your copywriting career with Iraqi Innovators! Specially designed for Arabic-speaking beginner writers in Iraq. Digital copywriting means crafting content for online audiences. This includes writing product pages for eCommerce websites, articles for blogs and news sites. As a digital copywriter (or digital content writer), you'll produce the written content for webpages, either working in an employed position or as a freelancer. Digital Copywriter delivers resources and training for digital copywriters. Find fulfilling career guidance to grow your digital copywriting business. Learn how to write copy for digital channels and consistently produce copy that builds your brand and gets results. Digital writing is different in two key ways: length and approach. Longer lead times to create copy with a longer shelf life; whether it's website copy, blogs.

You'll also receive constructive feedback on your assignments. Learn More. Writing Digital Content. Copywriting is the foundation of any digital marketing. It creates a personal connection with your audience and is essential to persuade readers to take the. Digital copywriting is similar to traditional copywriting in that you are writing copy for marketing purposes. We write to tell a brand's story. This guide will give you the tools you need to create thumb-stopping digital marketing copy, including 21 copywriting tips and tricks and examples of good. Digital copywriting means crafting content for online audiences. This includes writing product pages for eCommerce websites, articles for blogs and news sites. Digital writing is different in two key ways: length and approach. Longer lead times to create copy with a longer shelf life; whether it's website copy, blogs. Still not convinced? · Copywriting connects you to your perfect customers. When you produce the right digital content, you won't need to spend your precious. What Does A Digital Copywriter Do? · End-to-end communication with clients via email, phone calls, and Zoom meetings from inception to publication. A good. Skillshare is a learning community for creators. Anyone can take an online class, watch video lessons, create projects, and even teach a class themselves. Copywriting is often the backbone of many digital marketing campaigns, so it's a good idea to think carefully about the text you put on your website, ads. I would say stick with copywriting and get really good at it. Learn to write ads, landing pages, VSLs, email campaigns, and long-form sales. Copywriting is a free online copywriting course designed to help both novice and veteran copywriters improve their copywriting skills. Combining SEO and User Experience knowledge with engaging writing, my digital copywriting services will create amazing journeys for your customers. 10 of the most in-demand digital copywriting projects, and practical tips for getting started and maximizing your income as a digital copywriter. For further insight on doing it right, here's our insider's guide to online copywriting that will whet your customers' appetite. The week Digital Content and Copywriting course covers the strategic copywriting and content creation skills necessary to plan, create and implement an. I think those schools teach you how to write traditional advertising like print, radio, etc. and the work is more creative. With digital copywriting, is that. Taking place on 20 September, this brand-new online day event will help you craft compelling copy that provides a return on your investment every time. As a good copywriter, you play a very important role in digital marketing as you can create a shift in customer perception and make a meaningful connection with. The week Digital Content and Copywriting course covers the strategic copywriting and content creation skills necessary to plan, create and implement an.

Roche Diagnostics Solutions

Roche molecular lab diagnostic solutions enable disease management across the healthcare continuum, from screening and prevention to diagnosis and monitoring. Roche is a leading provider of in-vitro diagnostics and a global supplier of transformative innovative solutions across major disease areas. We are passionate about transforming healthcare by delivering novel diagnostic solutions to help improve patients' lives. Learn more. Roche Diagnostics is a division of Roche. Diagnostics solutions enable laboratories to be the trusted partners healthcare professionals need. Roche, a global leading healthcare company whose “aim is to discover, develop and market innovative solutions that bring clear medical benefit in disease. Roche Diagnostics serves customers spanning the entire healthcare spectrum - from research institutions, hospitals and commercial laboratories to physicians. Roche Diagnostics develops innovative products and services that address the prevention, diagnosis, monitoring, screening and treatment of diseases. We're passionate about transforming healthcare by delivering novel diagnostic solutions to help improve patients' lives. shanszavod.ru We develop diagnostic tests, instruments and digital solutions with the power to transform healthcare for people around the U.S. Learn more about our business. Roche molecular lab diagnostic solutions enable disease management across the healthcare continuum, from screening and prevention to diagnosis and monitoring. Roche is a leading provider of in-vitro diagnostics and a global supplier of transformative innovative solutions across major disease areas. We are passionate about transforming healthcare by delivering novel diagnostic solutions to help improve patients' lives. Learn more. Roche Diagnostics is a division of Roche. Diagnostics solutions enable laboratories to be the trusted partners healthcare professionals need. Roche, a global leading healthcare company whose “aim is to discover, develop and market innovative solutions that bring clear medical benefit in disease. Roche Diagnostics serves customers spanning the entire healthcare spectrum - from research institutions, hospitals and commercial laboratories to physicians. Roche Diagnostics develops innovative products and services that address the prevention, diagnosis, monitoring, screening and treatment of diseases. We're passionate about transforming healthcare by delivering novel diagnostic solutions to help improve patients' lives. shanszavod.ru We develop diagnostic tests, instruments and digital solutions with the power to transform healthcare for people around the U.S. Learn more about our business.

About Roche Diagnostics We are passionate about transforming healthcare by delivering novel diagnostic solutions to help improve patients' lives. Roche Diagnostics develops and delivers innovative, cost-effective, timely, and reliable diagnostic systems and solutions to support early detection and. Roche Diagnostics' digital pathology products combine innovative hardware and software, including uPath suite of image analysis algorithms, to be used together. The combined strengths of pharmaceuticals and diagnostics, as well as growing capabilities in the area of data-driven medical insights help Roche deliver truly. Our solutions. We develop diagnostic tests, instruments and digital solutions with the power to transform healthcare for people around the globe. Roche Diagnostics is a division of Roche Holding that provides diagnostic solutions. It offers analyzers, scanners, modular systems, and other products for. Roche Diagnostics leans heavily on marketing automation technology as it strives to deliver a personalized omnichannel customer experience at scale. But the. Shop point-of-care diagnostic instruments and more that deliver reliable accuracy, improve decisions and outcomes, and help people live healthier lives. Roche Molecular Diagnostics offers a broad range of assays to detect and quantify viral and bacterial pathogens, in both single and multiplex formats. Solutions. Roche is actively involved, from detecting illness and determining disease to providing treatments and monitoring progress of therapy. Diagnostic solutions. At Roche Diagnostics, we develop diagnostic tests, instruments and digital solutions with the power to transform healthcare for. We focus on finding new medicines and diagnostics and utilising data-based insights to evolve the practice of medicine and help patients live longer, better. We're passionate about transforming healthcare by delivering novel diagnostic solutions to help improve patients' lives. #WeAreRoche · 94 posts · followers. At Roche Diagnostics, we develop diagnostic tests, instruments and digital solutions with the power to transform healthcare for people around the globe. Our North American headquarters for Roche Diagnostics Corporation is located in Indianapolis. We have been part of this community since when. Roche Diagnostics is a division of Roche. We develop and integrate diagnostic solutions that address the challenges of today and anticipate the needs of. Roche Diagnostics USA | followers on LinkedIn. We're passionate about transforming healthcare by delivering novel diagnostic solutions to help improve. Roche Diagnostics is the market leader in the in vitro diagnostics business and provides the largest number of test results, empowering physicians and patients. Hoffmann-La Roche Ltd, is a provider of diagnostic system solutions to clinics, laboratories and doctors' offices. The company develops, produces and services. Performed on blood, tissue or other patient samples, in vitro diagnostics (IVDs) are a critical source of objective information for improved disease management.

Tax On Ira Withdrawal After 65

You can withdraw money any time after age 59½, but you'll need to pay income taxes on part or all of any IRA withdrawals you make. Step. 3. Savings growth vs. For income tax years beginning January 1, , and after, taxpayers 65 IRA distributions may include distributions made from a traditional IRA, a. Your withdrawals from a Roth IRA are tax free as long as you are 59 ½ or older and your account is at least five years old. Withdrawals from traditional IRAs. If I take out withdrawals from my (k) after age 59 1/2, are those distributions taxed as income? Your age does not matter. A distribution from a k is. are taxable upon withdrawal. Roth IRAs. Roth IRA contributions were taxed when you made them. For more information on the taxability of Roth. IRA. Withdrawals made for non-medical expense reasons may be subject to ordinary income taxes and an additional 20% tax. After you reach age 65, you may withdraw the. A distribution from a traditional IRA will be included in the owner's income as ordinary income and, depending on the owner's age, may also be subject to a 10%. personal income tax rules with regard to tradi- tional and Roth IRAs. • Contributions are not tax deductible. • Withdrawals are generally not taxable after a. At retirement, the distributions will be tax-free. The Traditional IRA saver will pay taxes when they take distributions, but because they are not paying taxes. You can withdraw money any time after age 59½, but you'll need to pay income taxes on part or all of any IRA withdrawals you make. Step. 3. Savings growth vs. For income tax years beginning January 1, , and after, taxpayers 65 IRA distributions may include distributions made from a traditional IRA, a. Your withdrawals from a Roth IRA are tax free as long as you are 59 ½ or older and your account is at least five years old. Withdrawals from traditional IRAs. If I take out withdrawals from my (k) after age 59 1/2, are those distributions taxed as income? Your age does not matter. A distribution from a k is. are taxable upon withdrawal. Roth IRAs. Roth IRA contributions were taxed when you made them. For more information on the taxability of Roth. IRA. Withdrawals made for non-medical expense reasons may be subject to ordinary income taxes and an additional 20% tax. After you reach age 65, you may withdraw the. A distribution from a traditional IRA will be included in the owner's income as ordinary income and, depending on the owner's age, may also be subject to a 10%. personal income tax rules with regard to tradi- tional and Roth IRAs. • Contributions are not tax deductible. • Withdrawals are generally not taxable after a. At retirement, the distributions will be tax-free. The Traditional IRA saver will pay taxes when they take distributions, but because they are not paying taxes.

There are no income tax penalties on traditional IRA withdrawals after age 59 1/2. Traditional IRAs are taxed at regular income tax rates. Do you pay tax on (k) after 65? Yes, withdrawals are taxed regardless of age. How much can I withdraw from my IRA without paying taxes? Roth IRA withdrawals. an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that has been converted to a Roth IRA;; the redemption of U.S. • $8, in taxable IRA distributions. • $5, in taxable (k) plan distributions tax years beginning on or after January 1, , until the tax year. Traditional IRA distributions · Penalties: If you wait until you're at least age 59 1/2, you won't pay the 10% early withdrawal penalty on your IRA withdrawals. Retirement income isn't taxed in 13 states — meaning you can avoid paying Uncle Sam on distributions from your (k), IRA and pension payouts. Distributions and withdrawals from a Roth IRA can only be rolled over to another Roth IRA. After that, your distributions from your traditional. Good news: You're now old enough to enjoy penalty-free withdrawals from any kind of IRA. But it's still critical to know how your withdrawal may be taxed. Learn. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds. Smart Tip: Taxes on Pension Income Vary by State. Generally, you have to pay income tax on any amount you withdraw from your SIMPLE IRA. You may also have to pay an additional tax of 10% or 25% on the amount. When you start withdrawing from your account at retirement age, you will pay taxes on the funds you take out. With a Roth IRA, you contribute to your IRA after. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. Therefore, your distributions are usually taxable. A Roth IRA is a little bit different. Virginia offers qualifying individuals ages 65 and older a. If it's a Roth IRA, then you don't pay taxes on withdrawals. You paid tax the year you earned the money that you deposited. Division VI of that legislation excludes retirement income from Iowa taxable income for eligible taxpayers for tax years beginning on or after January 1, ), such as IRA, (K), and Keough plans, and government deferred compensation plans (IRS Sec. ). The combined total of pension and eligible retirement. You can withdraw what you have contributed to your Roth IRA—that is, your after-tax contributions, or what's known as “basis”—at any time without paying taxes. "A Roth IRA or Roth (k) can help you save on taxes in retirement. Not only are withdrawals potentially tax-free,2 they won't impact the taxation of your.

Eurodollar Exchange

Euro foreign exchange reference rates. The reference rates are usually updated at around CET every working day, except on TARGET closing days. They are. The fastest and simplest converter from Euro to US Dollar and from US Dollar to Euro Definitely not correcting the exchange rate and hasn't been updated since. The Euro US Dollar Exchange Rate - EUR/USD is expected to trade at by the end of this quarter, according to Trading Economics global macro models and. Mastercard currency converter tool calculates foreign exchange rates for all the major currencies worldwide to enable cross-border purchases and ATM. Official euro exchange rates from to the present. Get the latest Euro to United States Dollar (EUR / USD) real-time quote, historical performance, charts, and other financial information to help you make. 1 EUR = USD Aug 25, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy to. Actual exchange rates in country may vary from this rate due to time variances affecting updates. The rate shown is the rate available only in the country of. %. (1Y). 1 USD = EUR. Aug 25, , Euro foreign exchange reference rates. The reference rates are usually updated at around CET every working day, except on TARGET closing days. They are. The fastest and simplest converter from Euro to US Dollar and from US Dollar to Euro Definitely not correcting the exchange rate and hasn't been updated since. The Euro US Dollar Exchange Rate - EUR/USD is expected to trade at by the end of this quarter, according to Trading Economics global macro models and. Mastercard currency converter tool calculates foreign exchange rates for all the major currencies worldwide to enable cross-border purchases and ATM. Official euro exchange rates from to the present. Get the latest Euro to United States Dollar (EUR / USD) real-time quote, historical performance, charts, and other financial information to help you make. 1 EUR = USD Aug 25, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy to. Actual exchange rates in country may vary from this rate due to time variances affecting updates. The rate shown is the rate available only in the country of. %. (1Y). 1 USD = EUR. Aug 25, ,

Yearly average currency exchange rates ; Denmark, Krone, ; Egypt, Pound, ; Euro Zone, Euro, ; Hong Kong, Dollar, Check live exchange rates for 1 USD to EUR with our USD to EUR chart. Exchange US dollars to euros at a great exchange rate with OFX. USD to EUR trend. Get Euro/US Dollar FX Spot Rate (EURUSD=X) real-time currency quotes, news, price and financial information from Reuters to inform your trading and. UN Operational Rates of Exchange ; Albania, ALL, Albania Lek(e) ; Algeria, DZD, Algerian Dinar ; American Samoa, USD, US Dollar ; Andorra, EUR, Euro. US dollar (USD). ECB euro reference exchange rate. 23 August EUR 1 = USD You can also access their new Currency Exchange Rates Converter tool to easily complete exchange rates conversions between the U.S. Dollar and any foreign. Euro/US Dollar FX Spot Rate · Price (USD) · Today's Change / % · 1 Year change+% · 52 week range - Eurodollar Eurodollar, a United States dollar that has been deposited outside the United States, especially in Europe. Foreign banks holding Eurodollars are. The Euro-dollar market is a market, located principally in Europe, for lending and borrowing the world's most important convertible currencies. The currency. A Eurodollar refers to funds that are denominated in U.S. dollars and held in foreign banks, or overseas branches of American banks. These funds can in the form. Interactive historical chart showing the daily Euro - U.S. Dollar (EURUSD) exchange rate back to CME listed FX futures offer more precise risk management of EUR/USD exposure through firm pricing, convenient futures and options, and trading flexibility. DOLLAR (CAD) 1 CAD = USD. CHINA, YUAN (CNY) 1 CNY = USD. DENMARK, KRONE (DKK) 1 DKK = USD. EUROZONE, EURO (EUR) 1 EUR = USD. Suggested Citation: Board of Governors of the Federal Reserve System (US), U.S. Dollars to Euro Spot Exchange Rate [DEXUSEU], retrieved from FRED, Federal. In depth view into Euro to US Dollar Exchange Rate including historical data from to , charts and stats. exchange requirements. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the. You must make all federal income tax determinations in your functional currency. The U.S. dollar is the functional currency for all taxpayers except some. Historical Rates for the EU Euro. (Rates in U.S. dollars per EU euro). Date, Rate. 3-JAN, 4-JAN, 5-JAN, 6-JAN, 7-JAN. Dive into historical exchange rates for EUR to USD with Wise's currency converter. Analyse past currency performance, track trends, and discover how.

Listing Date Of Ipos

Learn more about upcoming IPOs at The New York Stock Exchange, which has a + year track record of supporting IPOs and innovating in the capital markets. The IPO listing Date marks the day when a company's shares are officially traded on a recognised stock exchange. Typically scheduled around three business days. IPO listing date is the date of new IPO listing in NSE and BSE (Mainboard IPO). This is the day when IPO shares start trading at the stock exchanges. Interested in investing in IPOs? · Listing Date · Issue Price ₹ · LTP ₹ · Change %. As per the SEBI circular (WEB), all IPOs must be listed on exchanges within T+3 days of the IPO closing date, beginning 1st December The table below. IPO Calendar ; Aug 16, , Hcm Ii Acq (HONDU), NASDAQ, M · IPO Calendar ; Cuprina Holdings (Cayman) LTD · CUPR, Network 1 Financial Securities, , ; Galaxy Payroll Group Ltd. GLXG, R.F. Lafferty & Co. , IPO Scorecard - August 22, · Archive · Other IPO Links · About Us · Contact Us. The latest information on initial public offerings (IPOs), including latest IPOs, expected IPOs, recent filings, and IPO performance from Nasdaq. Learn more about upcoming IPOs at The New York Stock Exchange, which has a + year track record of supporting IPOs and innovating in the capital markets. The IPO listing Date marks the day when a company's shares are officially traded on a recognised stock exchange. Typically scheduled around three business days. IPO listing date is the date of new IPO listing in NSE and BSE (Mainboard IPO). This is the day when IPO shares start trading at the stock exchanges. Interested in investing in IPOs? · Listing Date · Issue Price ₹ · LTP ₹ · Change %. As per the SEBI circular (WEB), all IPOs must be listed on exchanges within T+3 days of the IPO closing date, beginning 1st December The table below. IPO Calendar ; Aug 16, , Hcm Ii Acq (HONDU), NASDAQ, M · IPO Calendar ; Cuprina Holdings (Cayman) LTD · CUPR, Network 1 Financial Securities, , ; Galaxy Payroll Group Ltd. GLXG, R.F. Lafferty & Co. , IPO Scorecard - August 22, · Archive · Other IPO Links · About Us · Contact Us. The latest information on initial public offerings (IPOs), including latest IPOs, expected IPOs, recent filings, and IPO performance from Nasdaq.

IPO - Initial Public Offering · Resourceful Automobile Lt · Issue Date 22 Aug - 26 Aug · Price ₹ · Ipo Size ₹ Cr. · Resourceful Automobile Lt. Apply. An Initial Public Offering, or IPO, is when a private company becomes a public company by offering shares on a securities exchange such as the New York. Past IPOs ; Dhariwalcorp Ltd, 08 Aug , ; Utssav CZ Gold Jewels Ltd, 07 Aug , ; Akums Drugs & Pharmaceuticals Ltd, 06 Aug , ; Bulkcorp. Key Takeaways. An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. An IPO calendar with all upcoming initial public offerings (IPOs) on the stock market. Includes IPO dates, prices, how many shares are offered and more. Recently Listed IPOs ; Company Name. AWFIS Space Solutions Ltd ; Listing Date. May ; Listing Price. ₹ ; Today's Gain (%). ; Last Trading Price. IPO News · IPO Calendar: Primary market continues to be robust with 8 news issues, 8 listings next week · Aeron Composite fixes price band at Rs /share for. The IPO listing date is tentatively scheduled for six* business days after the closing date of the IPO. Once the Company determines the final listing date, it. Companies listed today are indicated in pink. Notes are indicated at the bottom of the page. Date of. Listing. Date", "link": "/market_information/announcements/entitlement_by_ex_date", "sequence": 3 }, { "title": "SPEEDS", "link": "/market_information/announcements. Learn which companies are planning to go public soon, and when they are scheduling their IPOs. Explore the most comprehensive IPO Calendar with Renaissance Capital, featuring upcoming IPOs, detailed analyses, and expert insights. An initial public offering (IPO) is a company's 1st entry into the public stock market. Sometimes referred to as “going public,” a company's IPO allows it. IPO Calendar · Open Date. Aug · Close Date. Aug Issue Price. Recently Priced IPOs ; RITR · Reitar Logtech · RITR, 08/22/24, $9 ; WOK · WORK Medical Technology · WOK, 08/22/24, $8. IPO listing date is the date when the company shares will list on the NSE and BSE (Mainboard IPO) or SME IPO will list on SME Emerge platforms respectively. On. An Initial Public Offerings (IPO) is the process of offering shares of a private company to the public in a new issuance of stock. An IPO is an important time. Click on any of the Below links to view IPO Allotment Status ; PREMIER ENERGIES LIMITED-IPO, 27/08/ It's best to begin the IPO planning to IPO completion process one or two years before the planned IPO date. Types of IPOs issued are fixed price, also. Listings. Trading & Data. Insights. About. NYSE IPO Center. IPO Data. Filings Recent IPOs. IPO Pricing Stats The Backlog. S&P Global. Priced Deals. Price Date.

Max Adjusted Gross Income For Roth Ira

Roth IRA Eligibility: MAGI is the same calculation as Traditional IRA formula above plus any Traditional IRA deduction reduced by income from a conversion of an. If you file taxes as a single person and your Modified Adjusted Gross Income (MAGI) is under $, in , or if you are married and file jointly and your. The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. If you'. For , the total maximum contributions you can make across all of your traditional (pre-tax) IRAs and Roth IRAs is $7, If you are over the age of Modified Adjusted Gross Income (MAGI) Limits Once you've determined your MAGI, use the scenarios below to determine the maximum amount you can contribute. The total contribution to all of your Traditional and Roth IRAs cannot be more than the annual maximum for your age or % of earned income, whichever is less. Contributions are made with after-tax dollars. You can contribute to a Roth IRA if your Adjusted Gross Income (AGI) is: Less than $, (single filer) If you are single, your income must be less than $95, (MAGI - modified adjusted gross income) in order to be eligible to fund the $3, maximum amount. To be eligible to contribute the maximum amount in , your modified adjusted gross income (MAGI) must be less than $, (up from $, last year) if. Roth IRA Eligibility: MAGI is the same calculation as Traditional IRA formula above plus any Traditional IRA deduction reduced by income from a conversion of an. If you file taxes as a single person and your Modified Adjusted Gross Income (MAGI) is under $, in , or if you are married and file jointly and your. The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. If you'. For , the total maximum contributions you can make across all of your traditional (pre-tax) IRAs and Roth IRAs is $7, If you are over the age of Modified Adjusted Gross Income (MAGI) Limits Once you've determined your MAGI, use the scenarios below to determine the maximum amount you can contribute. The total contribution to all of your Traditional and Roth IRAs cannot be more than the annual maximum for your age or % of earned income, whichever is less. Contributions are made with after-tax dollars. You can contribute to a Roth IRA if your Adjusted Gross Income (AGI) is: Less than $, (single filer) If you are single, your income must be less than $95, (MAGI - modified adjusted gross income) in order to be eligible to fund the $3, maximum amount. To be eligible to contribute the maximum amount in , your modified adjusted gross income (MAGI) must be less than $, (up from $, last year) if.

For example, for the tax year , a couple filing jointly and reporting less than $, in adjusted gross income may contribute the annual maximum of. Betsy Harms is a single taxpayer with wages of $95,, and a modified adjusted gross income of $, Betsy is age. She has not made a contribution to. For investors aged 50 and older, this maximum is increased to $8, To be eligible to contribute to a Roth IRA, your Modified Adjusted Gross Income (MAGI). Married filing separately — If you are married, filing separately and your AGI is greater than $10,, you may not be eligible to contribute to a Roth IRA. The modified adjusted gross income (MAGI) you report on your tax return is used to determine if you qualify for certain tax benefits. The Marketplace uses a number called "modified adjusted gross income (MAGI)" to determine if you qualify for savings. What's a modified adjusted gross income . The amount of money you can contribute to a Roth IRA depends on how much you earn and your Modified Adjusted Gross Income (MAGI), which is essentially what you. Filing status, Modified adjusted gross income (MAGI), Contribution limit ; Single individuals. Depending on your modified adjusted gross income (MAGI), your Roth IRA contribution may result in an excess contribution. TurboTax will calculate your MAGI. For example, for the tax year , a couple filing jointly and reporting less than $, in adjusted gross income may contribute the annual maximum of. In , you can contribute a total of up to $, or $ if you're age 50 or older, to all of your Roth and traditional IRA accounts. Tax Breaks for Roth IRA Contributions · Taxpayers who are married and filing jointly must have incomes of $76, or less in · All head-of-household filers. Adjustments include deductions for conventional IRA contributions, student loan interest, and more. Adjusted gross income appears on IRS Form , line $ if your income is low enough (and $ if you're 50 or older) for $ more than that for zero (that is, you can't contribute at all) if your. Your total (or “gross”) income for the tax year, minus certain adjustments you're allowed to take. Adjustments include deductions for conventional IRA. To make the full $7, (or $8, if you're age 50 or older) contribution to a Roth IRA for the tax year, your modified adjusted gross income must be less. Roth IRA MAGI Limits ; Filing Status. Modified Adjusted Gross Income (MAGI). Contribution Limit ; Single or Head of Household. Less than $, Full. Calculate Your Credit ; 50% of your contribution, AGI not more than $46,, AGI not more than $34, ; 20% of your contribution, $46, – $50,, $34, –. Calculate Your Credit ; 50% of your contribution, AGI not more than $46,, AGI not more than $34, ; 20% of your contribution, $46, – $50,, $34, –. Filing Status, Modified AGI, Contribution Limit ; Married filing jointly or qualifying widow(er), Less than $,, $6, ($7, if you're age 50 or older.