shanszavod.ru

Community

What Days Is Cheapest To Buy Plane Tickets

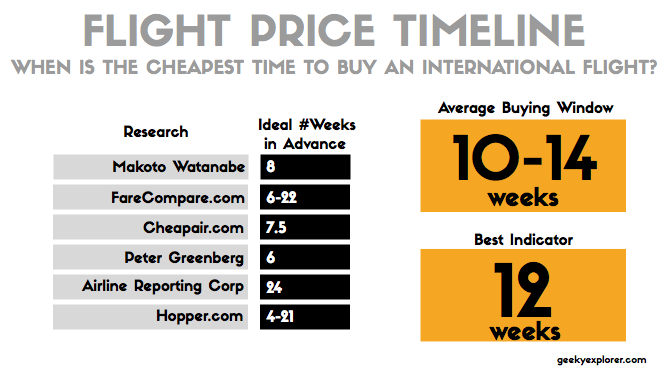

Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. Book and compare the cheapest flights from all major airlines and online travel agents, and find the best plane tickets to all your favorite destinations. Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. In general, the "sweet spot" for Southwest fares during non-peak travel times is weeks out. Fares are high when the schedule is first release, tend to drop. The Cheapest Day to Buy an International Flight is on a Thursday. Believe it or not, the day on which you search for and book your international flight has a. Though last-minute deals aren't unicorn-level rare, you'll likely get the best prices at least three weeks in advance. Instead of zooming in on a specific day. I've always had the best luck flying out & in on a Saturday, booking on a Tuesday. For both U.S. domestic and international travel, Sundays can be cheaper for airline ticket purchases. Fridays tend to be the most expensive day to book a flight. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive. Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. Book and compare the cheapest flights from all major airlines and online travel agents, and find the best plane tickets to all your favorite destinations. Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. In general, the "sweet spot" for Southwest fares during non-peak travel times is weeks out. Fares are high when the schedule is first release, tend to drop. The Cheapest Day to Buy an International Flight is on a Thursday. Believe it or not, the day on which you search for and book your international flight has a. Though last-minute deals aren't unicorn-level rare, you'll likely get the best prices at least three weeks in advance. Instead of zooming in on a specific day. I've always had the best luck flying out & in on a Saturday, booking on a Tuesday. For both U.S. domestic and international travel, Sundays can be cheaper for airline ticket purchases. Fridays tend to be the most expensive day to book a flight. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive.

For instance, according to Expedia's Travel Hacks Report, Sunday is the best day of the week to find cheaper flights—and has been for the past 5 years The window for the best deals on domestic flights in the Canada is usually between three months and 30 days before departure. Useful tools to help you find the best deals. Find the cheapest days to fly. The Date grid and Price graph make it easy to see the best flight deals. If at all possible, consider putting off travel until the fall or winter months. Scott Keyes, founder of Scott's Cheap Flights, tells Select there are. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. Find cheap flights and save money on airline tickets to every destination in the world at shanszavod.ru Whether you already know where and when you want. According to Expedia and the ARC, Sundays are the best days to be buying your flights - you can often save up to 13% from the Friday price - with Tuesday being. According to Google Flights, the cheapest flights are available when flying on Monday, Tuesday and Wednesday, with Tuesday being the cheapest day, according to. Frequent travelers may already know this, but earlier in the week can be the cheapest time to fly. In , flights departing on a Monday were generally the. Flying midweek or on Saturdays generally yields lower fare prices while Sundays, Fridays, and Mondays can be expensive flying days. At the airport, visit the. According to Google Flights, the cheapest flights are available when flying on Monday, Tuesday and Wednesday, with Tuesday being the cheapest day, according to. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. When is the best time to buy plane tickets - Last minute or in advance? On average, starting your trip on a Tuesday or a Wednesday will also help you save some money on you airfare. 9. Be flexible. When searching for a plane ticket. What is the cheapest day to buy plane tickets? Any day of the week. Booking on one day versus another isn't going to make a difference. "That used to be true;. Yeah, first, always book your tickets for Tuesdays, Wednesdays, and Saturdays. These are by far the cheapest days to book tickets. Wow, what. Cheap Flight Day – August 23, Hopefully, you globetrotters marked your calendars for Cheap Flight Day, August 23, well in advance. While many people. Here is a little secret: the cheapest time of the year to book a flight is on any Sunday in January. When is the best month to book flights? Booking a holiday. AirHint tracker and predictor recommends the best time to buy airline tickets. We track and analyze airfares, predicts plane ticket price changes and offers. cheapest day to book flights? Discover the truth behind buying flight tickets at the airport and the pros and cons of booking your next trip at the ticket.

What Is The Refinance Rate For 30 Year Fixed

Interested in refinancing your mortgage? View today's mortgage refinance rates for fixed-rate year fixedRate Mortgage popup. Rate %. APR %. The current average year fixed mortgage rate fell 4 basis points from % to % on Saturday, Zillow announced. The year fixed mortgage rate on. On Saturday, September 14, , the national average year fixed refinance APR is %. The average year fixed refinance APR is %, according to. Year Fixed Mortgage. Get a fixed interest rate and lower monthly payments. Take the first step toward buying a house. Year Fixed Rate ; Rate: % ; APR: % ; Points.5 ; Estimated Monthly Payment: $1, See today's 30 year refinance mortgage rates. Lower 30 year refinance rates could help you get lower monthly payments. year mortgage: %. Average refinance rates today: year refinance: %; year refinance: %. Find the best mortgage. On a national average, the lowest rate was % for the last year. Keep in mind that mortgage rates in general have more than doubled since the start of year fixed-rate mortgage: Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-rate mortgage. Interested in refinancing your mortgage? View today's mortgage refinance rates for fixed-rate year fixedRate Mortgage popup. Rate %. APR %. The current average year fixed mortgage rate fell 4 basis points from % to % on Saturday, Zillow announced. The year fixed mortgage rate on. On Saturday, September 14, , the national average year fixed refinance APR is %. The average year fixed refinance APR is %, according to. Year Fixed Mortgage. Get a fixed interest rate and lower monthly payments. Take the first step toward buying a house. Year Fixed Rate ; Rate: % ; APR: % ; Points.5 ; Estimated Monthly Payment: $1, See today's 30 year refinance mortgage rates. Lower 30 year refinance rates could help you get lower monthly payments. year mortgage: %. Average refinance rates today: year refinance: %; year refinance: %. Find the best mortgage. On a national average, the lowest rate was % for the last year. Keep in mind that mortgage rates in general have more than doubled since the start of year fixed-rate mortgage: Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-rate mortgage.

Year Fixed Rate · Interest% · APR%.

The interest rate is lower than a year fixed mortgage. However, your monthly payment is higher than a year mortgage because your repayment period is. Buying A Home Refinancing. Year Fixed. Rate%. /. APR%. Points. (). What are APR and points? Apply To Refinance · Learn About Year Fixed Loans. Year. year fixed mortgage rates for September 13, ; year fixed VA ; year fixed VA, %, %. Today's current year, fixed-rate mortgage rates* · Purchase price: $, · Down payment: % · First Lien Position · Primary residence · FICO Score. Today's year fixed refinance rates. % Rate. % APR. A Mortgage Refinance with Discover comes with a low fixed rate and $0 costs due at closing · Refinance Rates Today · Term Length Options: · Rate Range: · Year. This lender's year fixed refinance rates start at %, assuming great credit, purchase of one point, 20% down and a single family residence. Chase does. A fixed-rate loan of $, for 30 years at % interest and % APR will have a monthly payment of $1, Taxes and insurance not included; therefore. Introduction to Year Fixed Mortgages ; 30 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. Shorter terms. Another reason is to shorten the terms of your mortgage. This could mean moving from a year to a year mortgage, for. Refinancing and equity guideToday's refinance ratesBest refinance lendersyear fixed refinance year fixed rate:APR %. %. Today. %. Over. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. The rates shown above are the current rates for the purchase of a single-family primary residence based on a day lock period. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. As of September 10, , the average year refinance mortgage APR is %. Terms Explained. 3. Buying A Home Refinancing. Year Fixed. Rate%. /. APR%. Points. (). What are APR and points? Apply To Prequalify · Learn About Year Fixed Loans. Year. year Fixed Mortgage Rate Predictions The NAHB saw year fixed rates rising to % in , when they anticipated ARMs to jump from estimates. Refinance rates ; yr fixed · % · % · ($3,) ; yr fixed FHA · % · % · ($3,) ; yr fixed · % · % · ($3,). National year fixed refinance rates go down to %. The current average year fixed refinance rate fell 1 basis point from % to % on Tuesday. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term.

Software Engineer Salary In Malaysia

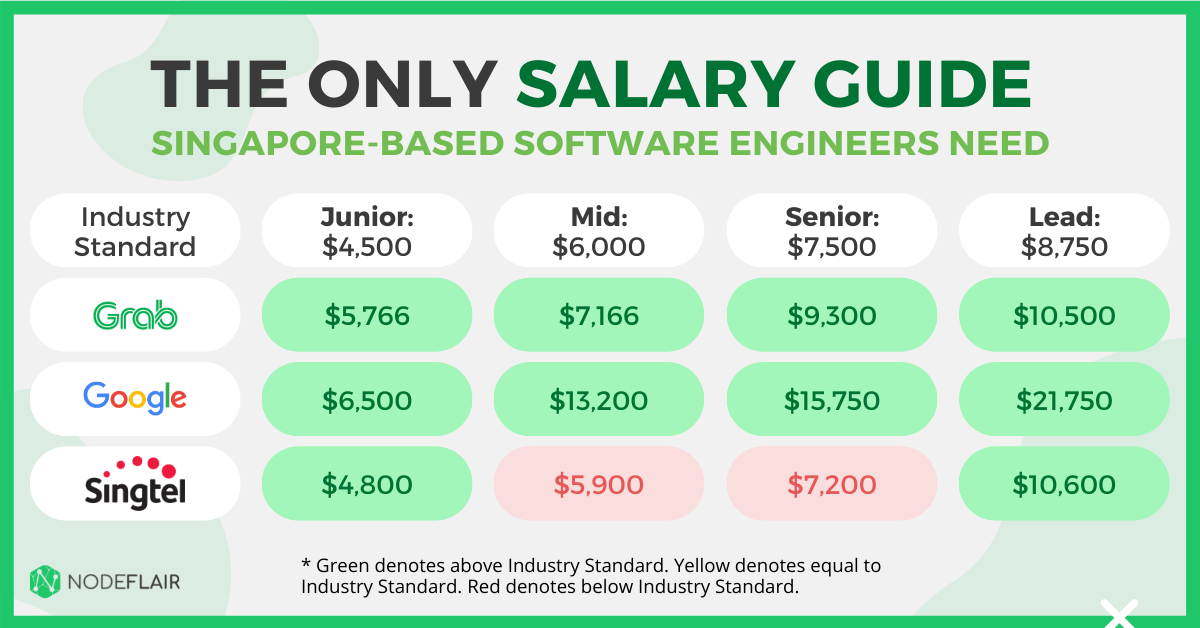

The average salary for a junior software engineer is RM 3, per month in Malaysia. salaries reported, updated at 25 August Kuala Lumpur, Malaysia. Sr. Director / Director of Executive Software Engineer (Security Platform, Distributed Systems). Engineering. US. Depends on company but on average that I've know senior typically gets anywhere from k. Junior with decent skillset can get k Mid level. Regional Senior Sales Manager, Platforms & Digital, SEAPetaling Jaya, Malaysia Site Reliability EngineerBangalore, India; Software Engineer - Big Data. A Software QA Engineer working in Malaysia will typically earn around 69, MYR per year, and this can range from the lowest average salary of about 32, MYR. Software engineers in Malaysia earn, on average, MYR 4, per month. An entry-level software engineer makes around MYR 8, monthly, while a principal. What can I earn as a Software Engineer? The average monthly salary for Software Engineer jobs in Malaysia ranges from RM 4, to RM 6, According to Payscale, lead software engineers in Malaysia can earn from MYR, to , per year. Software engineer job opportunities. A software. Software developers working remotely in Malaysia expect an average of $ in See how the numbers compare to other locations in this region. The average salary for a junior software engineer is RM 3, per month in Malaysia. salaries reported, updated at 25 August Kuala Lumpur, Malaysia. Sr. Director / Director of Executive Software Engineer (Security Platform, Distributed Systems). Engineering. US. Depends on company but on average that I've know senior typically gets anywhere from k. Junior with decent skillset can get k Mid level. Regional Senior Sales Manager, Platforms & Digital, SEAPetaling Jaya, Malaysia Site Reliability EngineerBangalore, India; Software Engineer - Big Data. A Software QA Engineer working in Malaysia will typically earn around 69, MYR per year, and this can range from the lowest average salary of about 32, MYR. Software engineers in Malaysia earn, on average, MYR 4, per month. An entry-level software engineer makes around MYR 8, monthly, while a principal. What can I earn as a Software Engineer? The average monthly salary for Software Engineer jobs in Malaysia ranges from RM 4, to RM 6, According to Payscale, lead software engineers in Malaysia can earn from MYR, to , per year. Software engineer job opportunities. A software. Software developers working remotely in Malaysia expect an average of $ in See how the numbers compare to other locations in this region.

A free inside look at Silverlake salary trends for Software Engineer based on user submitted salaries and past job listings. A person working as Software Engineer in Malaysia typically earns around 6, MYR. Salaries range from 3, MYR (lowest) to 10, MYR (highest). Software Engineering Group. League of Legends. Los Angeles, USA · Staff Software Engineer - VALORANT, Expressions Engineering. Software Engineering Group. Kuala Lumpur, Malaysia. Kuna, ID. Leamington Spa, UK "To be a successful engineer, empathy is key." Read more. Nishita A., Software Engineering Manager. The average Software Engineer salary range in Kuala Lumpur, Malaysia is from $ to $ View Software Engineer salaries across top companies broken. salary for the role. This salary range may be inclusive of several career Malaysia. English · 简体中文. MT Malta. English. MX Mexico. Español · English. NL. The average api software engineer salary in Malaysia is $ or an equivalent hourly rate of $ Salary estimates based on salary survey data collected. The average monthly salary for Software Developer jobs in Malaysia ranges from RM 3, to RM 6, Senior Software Engineer (NodeJs & Javascript). STRATEQ. M posts. Discover videos related to Software Engineer Salary in Malaysia on TikTok. See more videos about Architect Salary Malaysia. The average salary for a Software Engineer in Malaysia is RM in Visit PayScale to research software engineer salaries by city, experience. The average salary range for an API Software Engineer is between MYR , and MYR , On average, a Bachelor's Degree is the highest level of education. The Software Engineer salary in Malaysia is RM6, (RM2, to RM14,). View all Software Engineer salaries broken down by base pay, stock, and bonus. Wondering how much Web3 Software Engineer in Malaysia get paid? Get insights into the average yearly salary of $79K, with a minimum base salary of $70K and. The average salary for a Senior Software Engineer in Malaysia is RM in Visit PayScale to research senior software engineer salaries by city. The average software engineer salary in Malaysia is RM, or an equivalent hourly rate of RM Salary estimates based on salary survey data collected. Average Pay: In Malaysia, software engineers earn between MYR 3, to MYR 8, per month when they start their careers. · Maximum Salary: Experienced Software. Malaysia, Mexico, Oman, Peru, Romania, Trinidad And Tobago, United Kingdom, United Engineer, RPF - RPE (Reservoir Performance Evaluation), Muscat, Oman. HR. The median annual salary for a remote Software Engineer in Malaysia is $48, This is the base salary, not including benefits. A person working as Software Engineer in Kuala Lumpur typically earns around 6, MYR. Salaries range from 3, MYR (lowest) to 10, MYR (highest). Salary.

Sqlserver Dateformat

How to Format Dates in SQL Server – Over Examples Included. January 18, You will love this blog because date functions and formatting differ. %M · Month name in full (January to December) ; %m, Month name as a numeric value (00 to 12) ; %p, AM or PM ; %r, Time in 12 hour AM or PM format (hh:mm:ss AM/PM). How to get SQL Date Format in SQL Server. Use the SELECT statement with CONVERT function and date format option for the date values needed; To get YYYY-MM-DD. How to Query Date and Time in SQL Server using Datetime and Timestamp · from · where · -- can include time by specifying in YYYY-MM-DD hh:mm:ss format: · select. If the client machine is set up as UK, the today function will provide the date as formatted in the second query. If the database server is setup as let's say. This TO_DATE function specifies the format pattern as "yyyy-MM-dd", which matches the provided string. It converts the string into a date value, allowing us to. If you have a date but you want to give it a format specific to a given country or culture, you can use the FORMAT function. Its syntax is pretty easy: FORMAT. Converting to a Date in a particular format 1 SELECT CONVERT(VARCHAR(10), getdate(), );. In this example, it returns /03/ Remember to define the. You should try getting used to using yyyy-mm-dd (or / or maybe. delimiter) when manipulating dates in SQL, there's no ambiguity with this. How to Format Dates in SQL Server – Over Examples Included. January 18, You will love this blog because date functions and formatting differ. %M · Month name in full (January to December) ; %m, Month name as a numeric value (00 to 12) ; %p, AM or PM ; %r, Time in 12 hour AM or PM format (hh:mm:ss AM/PM). How to get SQL Date Format in SQL Server. Use the SELECT statement with CONVERT function and date format option for the date values needed; To get YYYY-MM-DD. How to Query Date and Time in SQL Server using Datetime and Timestamp · from · where · -- can include time by specifying in YYYY-MM-DD hh:mm:ss format: · select. If the client machine is set up as UK, the today function will provide the date as formatted in the second query. If the database server is setup as let's say. This TO_DATE function specifies the format pattern as "yyyy-MM-dd", which matches the provided string. It converts the string into a date value, allowing us to. If you have a date but you want to give it a format specific to a given country or culture, you can use the FORMAT function. Its syntax is pretty easy: FORMAT. Converting to a Date in a particular format 1 SELECT CONVERT(VARCHAR(10), getdate(), );. In this example, it returns /03/ Remember to define the. You should try getting used to using yyyy-mm-dd (or / or maybe. delimiter) when manipulating dates in SQL, there's no ambiguity with this.

You can convert a DATETIME to a DATE using the CONVERT function. The syntax for this is CONVERT (datetime, format). Using the CONVERT Function to Format Dates and Times in SQL Server · GETDATE(): It returns server datetime in “YYYY-MM-DD HH:mm:ss. · GETUTCDATE(): It returns. DATE values have YYYY-MM-DD format, where YYYY represent the full year (4 digits), whereas the MM and DD represents the month and day parts of the date. The GETDATE() function returns the current database system date and time, in a 'YYYY-MM-DD hh:mm:shanszavod.ru' format. Tip: Also look at the CURRENT_TIMESTAMP. Dates have no format, they're binary values. nvarchar isn't a date type. Use the correct type, date, datetime2, datetimeoffset, datetime. DATETIME(fsp), A date and time combination. Format: YYYY-MM-DD hh:mm:ss. The supported range is from ' ' to ' '. Adding. The dd-mm-yyyy format is also known as the "day-month-year" format. In this format, the day is listed first, followed by the month and then the year. For. SELECT CONVERT(varchar, date, 'YYYY-MM-DD') + ' ' + CONVERT(varchar, time, 'HH:MM') FROM events;. This query would return the result , The CONVERT function can convert datetime to string values. Optionally, the date format can be specified with a style argument. yyyy – The four-digit year. The table below presents more date/time format specifiers: specifier, description. d, Day in the range. The solution is indeed to use the mutators on the model, using setDateAttribute & getDateAttribute to return the required format for inserting and reading the. This TO_DATE function specifies the format pattern as "yyyy-MM-dd", which matches the provided string. It converts the string into a date value, allowing us to. Use the CONVERT() function to change the format of a date from a given column or expression. This function takes three arguments: The new data type (in our. Example 3: Formatting culture-aware date We can format dates into different languages with the culture parameter. DECLARE @d DATE = CAST('' AS DATE). The DATE data type specifies a date in SQL Server. DATE supports dates from through The default format is YYYY-MM-DD. SQL Server outputs date, time and datetime values in the following formats: yyyy-mm-dd, hh:m:shanszavod.run (n is dependent on the column definition). The valid date format is yyyy-mm-dd. Function, Descriptions. ISDATE, This function is used to check the entered dates follows the standard format of date, time. Oracle and PostgreSQL provide the TO_DATE() function that converts a string to date based on a specified format. The following shows the TO_DATE() function. In this guide, we cover the various methods that you can use to convert DateTime format to other SQL date formats, providing clear examples. TIMESTAMP - format: YYYY-MM-DD HH:MI:SS; YEAR - format YYYY or YY. SQL Server comes with the following data types for storing a date or a date/time value in the.

What To Invest In That Will Make Money

Investors buy shares and invest in assets in the hopes of making a profit in the future by either growing their assets or earning an income through dividends. Mutual fund: An investment vehicle that allows you to invest your money in a professionally-managed portfolio of assets that, depending on the specific fund. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. The reason to buy shares in a company is so you can profit from that company's performance. There are two ways your shares can make you money. Capital gains. All investing is subject to risk, including the possible loss of money you invest. Vanguard's advice services are provided by Vanguard Advisers, Inc. ("VAI"), a. Planning for the future can be a low priority, until it is. See how you can turn that around fast and find extra money to put towards your investment. With a $10, investment, there are a number of ways to make money. One option is to invest in the stock market. This can be done through a. While you could simply add that cash to your savings for short-term goals, now may be the time to consider investing for longer-term goals by buying individual. can reinvest profits effectively or if it's simply accumulating cash make informed decisions that could shape their investment journey and financial future. Investors buy shares and invest in assets in the hopes of making a profit in the future by either growing their assets or earning an income through dividends. Mutual fund: An investment vehicle that allows you to invest your money in a professionally-managed portfolio of assets that, depending on the specific fund. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. The reason to buy shares in a company is so you can profit from that company's performance. There are two ways your shares can make you money. Capital gains. All investing is subject to risk, including the possible loss of money you invest. Vanguard's advice services are provided by Vanguard Advisers, Inc. ("VAI"), a. Planning for the future can be a low priority, until it is. See how you can turn that around fast and find extra money to put towards your investment. With a $10, investment, there are a number of ways to make money. One option is to invest in the stock market. This can be done through a. While you could simply add that cash to your savings for short-term goals, now may be the time to consider investing for longer-term goals by buying individual. can reinvest profits effectively or if it's simply accumulating cash make informed decisions that could shape their investment journey and financial future.

Don't just let the money stay on saving bank account. The money should work. Starting small investing in investment account whenever possible. Research such. The advantage of investing yourself is that you're in control of all the decisions. It can also be cheaper than paying someone to invest your money. The risk is. How investors can make money with mutual funds. Mutual fund returns can come When a mutual fund sells investments that have increased in price, it will. Anyone Can Learn to Invest Wisely With This Bestselling Investment System! Through every type of market, William J. O'Neil's national bestseller How to Make. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. Everyone invests to make money, but you can make money from your investments in two ways. The various conservative income options, for example, make regular. Stockholders can make money in two ways—receiving dividend payments and selling stock that has appreciated. A dividend is an income distribution by a. To invest in yourself you want to spend money on things that will put you in a better position to earn money in the future. This means spending. While dividend investing can be a reliable income-producing asset, several tech companies, including the internet and biotech, commonly do not pay dividends. It's tempting to put off investing. You can think of plenty of excuses: I haven't saved enough money yet, it's time-consuming, or I don't know where to. 1. Play the stock market. · 2. Invest in a money-making course. · 3. Trade commodities. · 4. Trade cryptocurrencies. · 5. Use peer-to-peer lending. · 6. Trade. As students begin to make money, the habit of saving should follow along with their future earnings. The Financial Wellness Center helps students to identify. According to the Pew Research Center, even among families who earn less than $35, per year, one-in-five have assets in the stock market. Investing is less. Real estate crowdfunding: Similar to investing in REITs, real estate crowdfunding allows you to pool your money with other people to invest in real estate. Anyone can learn to invest wisely with this bestselling investment system! Through every type of market, William J. O'Neil's national bestseller, How to Make. Best way To Invest Money In Canada By Andrew Goldman. All the fundamentals the beginning investor should know to make wise investment decisions. Find out. You can create a ladder by investing in a mix of bonds with short, medium and long durations. “Most income investors want regular, reliable payments, which. Bonds and Gilts Bonds and gilts are a way for companies or governments to raise money which is done by borrowing money from investors. When you invest in a. What Are the Most Common Types of Investments? · Stocks: Companies sell shares of stock to the public to raise money for their operations. · Bonds: Companies and. As savings held in cash will tend to lose value because inflation reduces their buying power over time, investing can help to protect the value of your money as.

Can My 401k Be Used As Collateral For A Loan

:max_bytes(150000):strip_icc()/collateral-loans-315195-v3-5bc4cbf746e0fb002693d842.png)

If you take out a line of credit with the Bank(s), the collateral securing your loan will be held in your account(s) subject to the terms of the Control. Some plans have an exception to this limit: If your vested balance is less than $10,, you can borrow up to your full vested balance. Not all plans. The Internal Revenue Service (IRS) does not allow (k) participants to use their retirement accounts as collateral for a loan. If I don't use my (k) to buy a house, when can I use my (k)?. You cannot use a k as collateral for a bank loan, but you can take a loan from your k provider, which must be paid back in regular payments deducted from. Securities held in a retirement account cannot be used as collateral to obtain a securities-based loan. Securities in a Wells Fargo Bank Priority Credit. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). Yes, you can borrow from your (k) plan to start a business, but only if your program administrator allows you to take out a loan. Can I Use My (k) as Collateral for a Loan? How to Pay Back a (k) Loan However, longer payback periods are allowed for (k) loans used to purchase a. If you take out a line of credit with the Bank(s), the collateral securing your loan will be held in your account(s) subject to the terms of the Control. Some plans have an exception to this limit: If your vested balance is less than $10,, you can borrow up to your full vested balance. Not all plans. The Internal Revenue Service (IRS) does not allow (k) participants to use their retirement accounts as collateral for a loan. If I don't use my (k) to buy a house, when can I use my (k)?. You cannot use a k as collateral for a bank loan, but you can take a loan from your k provider, which must be paid back in regular payments deducted from. Securities held in a retirement account cannot be used as collateral to obtain a securities-based loan. Securities in a Wells Fargo Bank Priority Credit. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). Yes, you can borrow from your (k) plan to start a business, but only if your program administrator allows you to take out a loan. Can I Use My (k) as Collateral for a Loan? How to Pay Back a (k) Loan However, longer payback periods are allowed for (k) loans used to purchase a.

Assets are pledged as collateral and held in a separate brokerage account at a broker-dealer. Unlike margin, these nonpurpose credit lines may not be used to. Money withdrawn from your (k) account will not be earning interest, so your retirement savings might not grow at the same rate. Using a personal loan to. The securities within your accounts serve as a source of collateral for the loan. You can anticipate borrowing rates of up to % of the value of your. Vested funds from individual retirement accounts (IRA/SEP/Keogh accounts) and tax-favored retirement savings accounts ((k) accounts) are acceptable sources. No. A (k) account cannot be pledged as collateral, other than as security for certain loans from the plan. Any legitimate lender would know. However, using your k to borrow money should be absolutely avoided. Here's why you should never borrow against your k: 1. It can set your further back in. With (k) funding, collateral is unnecessary since you use your funds. Invest in Yourself: You're essentially betting on yourself using your retirement. No. That's not allowed for K nor for an IRA. IRS would treat it as if you did a full disbursement of your retirement fund. You can receive a plan loan or a. In effect, you actually use your own retirement savings as collateral for the loan. your account, like you would if you applied for a bank loan. Having. However, Tier 2 vested employer required contributions can be used to Can I pay off my loan early? You can make additional payments to the loan. A qualified plan may, but is not required to provide for loans. If a plan provides for loans, the plan may limit the amount that can be taken as a loan. The. Using your securities to borrow money. You can use securities as collateral for a loan. Here's what you need to know. Fidelity Learn. Key takeaways. You can. The IRS doesn't allow you to use an IRA as collateral for a loan. IRS Publication classifies this as a "prohibited transaction.". Money withdrawn from your (k) account will not be earning interest, so your retirement savings might not grow at the same rate. Using a personal loan to. A decline in the value of your collateral assets may require you to provide additional funds or securities to avoid a collateral maintenance call. You can lose. Margin loan. This type of loan is also backed by your investments and is typically used by active traders to buy more securities. The amount you can borrow. With a secured personal loan, putting up collateral will get you better interest rates and terms. There are a variety of assets you can use to secure a personal. These loans are typically called margin loans. The investments in your account are used as collateral for the loan. You may use the money that you borrow. Other restrictions may apply that could impact your loan availability. The loan is secured by collateral which equals % of the outstanding loan balance and. You may borrow a minimum of $1, up to a maximum of $50, or 50% of your vested account balance reduced by your highest outstanding loan balance during the.

Boa Car Rates

Interest rate discounts of up to % for Bank of America Preferred Rewards® members.,; Financing for certain exotic vehicles including Aston Martin®, Bentley®. Does Bank of America auto refinance have a fixed or variable APR? Bank of America offers a fixed APR for car refinancing starting from %. Does Bank of. Use Bank of America's auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan. Loan Rates · Auto Loan Calculator · Loans · Alerts · Protect Your Credit Score · Basic Banking · Online and Mobile · Checking, Savings, and Debit · Transfers. Today's lowest auto financing rate · A term of 60 months or less · A credit score of or higher · A vehicle less than 1 year old · A loan amount of $40, or. What are the best auto loans these days. I am getting 6% from Bank of America but and above from credit unions. I have excellent credit score. Example: A 5-year, fixed-rate new car loan for $62, would have 60 monthly payments of $1, each, at an annual percentage rate (APR) of %. A month New Auto loan with a % fixed APR would have monthly payments of $ per one thousand dollars borrowed. For used vehicle model years Calculate your potential auto refinance savings. Use this auto refinance calculator to compare your current loan with a refinance loan. Interest rate discounts of up to % for Bank of America Preferred Rewards® members.,; Financing for certain exotic vehicles including Aston Martin®, Bentley®. Does Bank of America auto refinance have a fixed or variable APR? Bank of America offers a fixed APR for car refinancing starting from %. Does Bank of. Use Bank of America's auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan. Loan Rates · Auto Loan Calculator · Loans · Alerts · Protect Your Credit Score · Basic Banking · Online and Mobile · Checking, Savings, and Debit · Transfers. Today's lowest auto financing rate · A term of 60 months or less · A credit score of or higher · A vehicle less than 1 year old · A loan amount of $40, or. What are the best auto loans these days. I am getting 6% from Bank of America but and above from credit unions. I have excellent credit score. Example: A 5-year, fixed-rate new car loan for $62, would have 60 monthly payments of $1, each, at an annual percentage rate (APR) of %. A month New Auto loan with a % fixed APR would have monthly payments of $ per one thousand dollars borrowed. For used vehicle model years Calculate your potential auto refinance savings. Use this auto refinance calculator to compare your current loan with a refinance loan.

Auto Loan Rates, Read Auto Loan Reviews & Save on Your Car Loan. Bank of America 60 Month Used Car Loan. shanszavod.ruy Payment. $ APR. Bank of America offers car financing up to $ with competitive rates and flexible terms. Members can qualify for discounts. If the interest rate you qualify for today is significantly lower than your current loan rate, it may be a good time to refinance a car. If it's the same or. With Personal Loan rates as low as % APRFootnote 1, now may be a great time to take care of your finances. Get started by checking your rates. Apply online today to refinance your existing auto loan and you may be able to lower your monthly payments. Benefits: · 90% financing for new · vehicles. · 85% financing for second hand vehicles · Tenure of up to 60 months · Zero processing fee · Compentitive interest rate. Best Auto Loan Rates of September · LightStream · Bank of America · MyAutoLoan · Consumers Credit Union · PenFed · RefiJet · Capital One · Carvana. When you take out a car loan from a financial institution, you receive your money in a lump sum, then pay it back (plus interest) over time. How much you borrow. No, Bank of America auto loan will not charge you a fee for paying your loan early. Whenever possible choose lenders like Bank of America auto loan that don't. Vehicle loan rates with the shanszavod.ru discount currently as low as % APR, depending on credit history, loan term and vehicle model year. You can review rates and apply for your auto loan online in just a few minutes. There's no fee to apply and most decisions are available in about 60 seconds. When I was working at the bank in my area from mid covid, lowest rates were about % for perfect credit. I hadn't bought a car since then. Save time by shopping for your car and your financing all in one place. Receive a loan decision for the vehicle you choose—it's fast and easy with Bank of. You may or may not have to make a down payment, sales tax is only charged on your monthly payments (in most states) and you pay a financial rate called a money. You should compare interest rates from several lenders to see which ones offer the best prices. You can also finance your vehicle through the vehicle. Bank of America is a horrible organization. The car dealer financed my car through BOA at an interest rate. I immediately refinanced with Navy Federal CU. Auto Loans · Benefits. For new or used vehicles – with the same low rates. Purchase or refinance – borrow to buy your next vehicle or refinance the one you drive. If the interest rate you qualify for today is significantly lower than your current loan rate, it may be a good time to refinance a car. If it's the same or. Bank of America Preferred Rewards® members are eligible for a discount on their auto loan rate of up to %, depending on your tier at the time of application. Bank of America, %, $35,, 60 months. US Bank, %, $35,, 36 months or less. Read more on Average Auto Loan Rates here. Reasons to Get an Auto Loan.

Llc What Is It

What is a limited liability company (LLC)?. A limited liability company (LLC) is a business structure in the United States that provides its owners with limited. A limited liability company, or LLC, is one of the simplest and most flexible business structures specific to the United States. Simply put, this hybrid legal. A limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC. A limited liability company (LLC) is a type of business structure in which the owners of a business have limited liability. This means that the owners are not. An LLC will allow a business owner to limit their personal liability for business debts, raise capital from investors, and benefit from many tax advantages. There are four types of legal entities a business can classify itself as. A limited liability company (LLC), C Corporation, S Corporation, or what is called. An LLC is not a corporation under the laws of every state; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. A limited liability company (LLC) is a business structure that combines elements of both a corporation and a partnership or sole proprietorship. An LLC provides. A limited liability company (LLC) is a business entity that prevents individuals from being liable for the company's financial losses and debt liabilities. In. What is a limited liability company (LLC)?. A limited liability company (LLC) is a business structure in the United States that provides its owners with limited. A limited liability company, or LLC, is one of the simplest and most flexible business structures specific to the United States. Simply put, this hybrid legal. A limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC. A limited liability company (LLC) is a type of business structure in which the owners of a business have limited liability. This means that the owners are not. An LLC will allow a business owner to limit their personal liability for business debts, raise capital from investors, and benefit from many tax advantages. There are four types of legal entities a business can classify itself as. A limited liability company (LLC), C Corporation, S Corporation, or what is called. An LLC is not a corporation under the laws of every state; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. A limited liability company (LLC) is a business structure that combines elements of both a corporation and a partnership or sole proprietorship. An LLC provides. A limited liability company (LLC) is a business entity that prevents individuals from being liable for the company's financial losses and debt liabilities. In.

The simple definition of a limited liability company (LLC) is that it is a form of business entity that limits the liability of its owners. An LLC will allow a business owner to limit their personal liability for business debts, raise capital from investors, and benefit from many tax advantages. The simple definition of a limited liability company (LLC) is that it is a form of business entity that limits the liability of its owners. A major disadvantage of an LLC is that owners may pay more taxes. When setting up as a pass-through to owners, they are subject to self-employment tax. Self-. A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state. A limited liability company (LLC) is a type of business structure that combines the flexibility and simplicity of a partnership or sole proprietorship with the. Pennsylvania Limited Liability Company. A Limited Liability Company (LLC) is a hybrid between a partnership and a corporation. It. A limited liability company, or an LLC, is a U.S business structure that gives you protection and flexibility to run your business, with relatively easy set. An LLC is a structure that has pass-through taxation and offers its owners limited liability. The LLC combines useful aspects of a solo proprietorship with a. A limited liability company, or LLC, is one of the most common business entities because it provides tax advantages and shields your personal property from. LLC vs. Corporation: Comparison. What is the difference between an LLC and a corporation? Deborah Sweeney, CEO of MyCorporation. The primary difference between an LLC and a corporation is that an LLC is owned by one or more members while a corporation is owned by shareholders. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Thus, an LLC with multiple owners. A limited liability company (LLC) is a type of business structure that combines the flexibility and simplicity of a partnership or sole proprietorship with the. An LLC is technically a “pass-through entity.” This means the government taxes members on their federal income tax returns. Any profits go straight to the. A limited liability company, commonly called an "LLC," is a business structure that fits somewhere between the corporation and the partnership or sole. An LLC, or limited liability company, is a legal business entity you form to protect your personal assets from liability. It will also establish how your. In this article, you can explore the major similarities and differences between a limited liability company (LLC) and a corporation (Inc.). A limited liability company (LLC) is a type of business entity that's popular for small business owners who want to create a legal separation between their. An LLC is a limited liability company. It is one of the most flexible entities and it is not a partnership or corporation. It is created by filing Articles.

Jetcoin Price

The live price of Jetcoin is $ per (JET / USD) today with a current market cap of $, USD. The hour trading volume is $ USD. JET to USD. JET-USD Jetcoin USD. Coin Price & Overview. Follow. $ (%) PM 07/27/ Cryptocurrency | $USD | CryptoCompare. Jetcoin's price has also risen by % in the past week. The current price is $ per JET with a hour trading volume of $ Currently, Jetcoin is. The price of Jetcoin (JET) is , market capitalization is with the circulating supply of JET. Since yesterday this crypto showed. Aug 4, - The live price of Jetcoin is $ JET price has increased by % in 24hrs, with a market cap of $ Jetcoin price today is $ JET price changed % in the last 24 hours. Get up to date Jetcoin charts, market cap, volume, and more. The live price of Jetcoin is $ per (JET / USD) with a current market cap of $ , USD. hour trading volume is $ USD. JET to USD price. Convert Jetcoin to US Dollar (JET to USD). The price of converting 1 Jetcoin (JET) to USD is $ today. The current price of Jetcoin is $ Discover JETC price trends, charts & history with Kraken, the secure crypto exchange. The live price of Jetcoin is $ per (JET / USD) today with a current market cap of $, USD. The hour trading volume is $ USD. JET to USD. JET-USD Jetcoin USD. Coin Price & Overview. Follow. $ (%) PM 07/27/ Cryptocurrency | $USD | CryptoCompare. Jetcoin's price has also risen by % in the past week. The current price is $ per JET with a hour trading volume of $ Currently, Jetcoin is. The price of Jetcoin (JET) is , market capitalization is with the circulating supply of JET. Since yesterday this crypto showed. Aug 4, - The live price of Jetcoin is $ JET price has increased by % in 24hrs, with a market cap of $ Jetcoin price today is $ JET price changed % in the last 24 hours. Get up to date Jetcoin charts, market cap, volume, and more. The live price of Jetcoin is $ per (JET / USD) with a current market cap of $ , USD. hour trading volume is $ USD. JET to USD price. Convert Jetcoin to US Dollar (JET to USD). The price of converting 1 Jetcoin (JET) to USD is $ today. The current price of Jetcoin is $ Discover JETC price trends, charts & history with Kraken, the secure crypto exchange.

What Is Jetcoin's Price Today? Jetcoin (JET) is trading at $ USD, decreasing by 0% since yesterday. Jetcoin has traded $42 USD in the last 24 hours. Find Jetcoin (JET) cryptocurrency prices, market news, historical data, and financial information. Make informed investment decisions with Jetcoin today. Track Jetcoin price today, explore live JET price chart, Jetcoin market cap, and learn more about Jetcoin cryptocurrency. Jetcoin Price Today IN - Check the latest Jetcoin price, JET live chart, market cap, trading volume, latest Jetcoin news, total circulating supply etc. with. Jetcoin USD Price Today - discover how much 1 JET is worth in USD with converter, price chart, market cap, trade volume, historical data and more. Discover Jetcoin (JET) price history. View historical data sorted by date range with open and close prices, trading volume and market cap. Jetcoin price today in BTC is Follow news and live (real-time) Jetcoin charts with over metrics to estimate future JET Value, exchange. Jetcoin JET price graph info 24 hours, 7 day, 1 month, 3 month, 6 month, 1 year. Prices denoted in BTC, USD, EUR, CNY, RUR, GBP. Jetcoin price stands at $, with market cap of $K and circulating supply of M. Jetcoin price is up +% in the last 24 hours and up +%. Q1. Can you please introduce yourself as well as Jetcoin?Founder / CEO: Eric AlexandreI'm. JET price today is $, with a live price change of in the last 24 hours. Convert, buy, sell and trade JET on Bybit. Track current Jetcoin prices in real-time with historical JET USD charts, liquidity, and volume. Get top exchanges, markets, and more. The current real time Jetcoin price is $, and its trading volume is $42 in the last 24 hours. JET price has plummeted by % in the last day, and. Aug 4, - The live price of Jetcoin is $ JET price has increased by % in 24hrs, with a market cap of $ 1 Jetcoin is currently worth USD. This means that you can convert 1 Jetcoin into USD at the current JET to USD exchange rate, which was last. Jetcoin Price. JET. $. %. 24H1W1M1YALL. Overview. Market cap. $K. 24h volume. $ 1W low. $ 1W high. $ Access real-time JET to USD rates and explore today's Jetcoin price with live updates, user-friendly charts, news forecasts and market cap data. Live Jetcoin price in PKR. JET price is Down by % today. Track real-time JET to PKR charts, market cap, supply, volume, prediction, historical data. Jetcoin price is estimated to reach $ by , at minimum. With an average trading price of $ throughout , Jetcoin's value could come to $ Jetcoin USD Overview. Jetcoin (JET) is a cryptocurrency and operates on the Ethereum platform. Jetcoin has a current supply of 80,, with.

What Are Small Cap Mutual Funds

Objective. Seeks capital appreciation. ; Strategy. Normally investing at least 80% of assets in securities of companies with small market capitalizations . View fund performance for the Thrivent Small Cap Stock Fund, a mutual Thrivent Distributors, LLC, member FINRA, is the distributor for Thrivent Mutual Funds. Small-cap mutual funds are invested in companies that are below the top stocks in the exchange as per their market capitalization. Small-cap mutual. View fund performance for the Thrivent Small Cap Stock Fund, a mutual fund which pursues long-term growth by investing in small-cap stocks. Small-Cap Fund (A). A diversified portfolio of small-cap stocks that seeks long-term capital appreciation. A. A small-cap fund does possess excellent potential to grow and deliver above market returns. However, there are a few things that an investor should know before. This low-cost index fund provides broad exposure to the small-capitalization U.S. equity market. The fund seeks to track an index of small-sized companies. What are small cap funds? SEBI has defined small-cap funds using a market cap based classification as part of its mutual fund categorization methodology. Large-. Small Cap Fund: These mutual funds select stocks for investment from the small cap category, which includes all stocks except largest stocks (by market. Objective. Seeks capital appreciation. ; Strategy. Normally investing at least 80% of assets in securities of companies with small market capitalizations . View fund performance for the Thrivent Small Cap Stock Fund, a mutual Thrivent Distributors, LLC, member FINRA, is the distributor for Thrivent Mutual Funds. Small-cap mutual funds are invested in companies that are below the top stocks in the exchange as per their market capitalization. Small-cap mutual. View fund performance for the Thrivent Small Cap Stock Fund, a mutual fund which pursues long-term growth by investing in small-cap stocks. Small-Cap Fund (A). A diversified portfolio of small-cap stocks that seeks long-term capital appreciation. A. A small-cap fund does possess excellent potential to grow and deliver above market returns. However, there are a few things that an investor should know before. This low-cost index fund provides broad exposure to the small-capitalization U.S. equity market. The fund seeks to track an index of small-sized companies. What are small cap funds? SEBI has defined small-cap funds using a market cap based classification as part of its mutual fund categorization methodology. Large-. Small Cap Fund: These mutual funds select stocks for investment from the small cap category, which includes all stocks except largest stocks (by market.

View fund performance for the Thrivent Small Cap Stock Fund, a mutual fund which pursues long-term growth by investing in small-cap stocks. A small-cap equity fund is an investment in the stock of companies with a market capitalization of less than Rs 5, crore. These companies are young and. These are two different types of equity mutual funds that invest in different kinds of companies, as defined by their market sizes, and hence exhibit different. Small cap core fund that focuses on investing in specific growth and value opportunities within the small cap segment (generally market caps up to $4 billion). Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small-cap. Growth is defined based on fast growth (high growth rates. Typically, they're defined by the size of the companies they invest in ("small-cap," "mid-cap," or "large-cap") or their investment objective ("growth," "income. Small cap mutual funds have the potential to offer higher returns than large cap and mid cap funds, as they invest in emerging businesses that have the scope to. It is common for big mutual funds to invest hundreds of millions of dollars in one company. Most small caps don't have the market cap to support these large. The portfolio typically invests in companies with a market capitalization below $3 billion (or, if greater, the maximum market capitalization of companies. Small Cap Mutual Funds invest in stocks of smaller companies, offering high growth potential but with increased risk due to market volatility. Learn more. Small-cap funds are the type of equity funds that invest in small companies (with market capitalisation of less than Rs. 5, crores) in India. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small cap. The blend style is assigned to portfolios where neither. The investment objective of the Small-Cap Equity Fund is to provide long-term growth of capital by investing primarily in the stocks of smaller companies. Small. The fund seeks to provide long-term capital growth by investing primarily in stocks of small companies. Small-cap funds can enhance the growth potential of a portfolio. They provide access to innovative and emerging companies that may become successful. However. Analyze the Fund Fidelity ® Small Cap Index Fund having Symbol FSSNX for type mutual-funds and perform research on other mutual funds. Small-Cap Fund (A) (ETEGX) - A diversified portfolio of small-cap stocks that seeks long-term capital appreciation. - Domestic Equity Fund. Small cap funds, as open-ended equity schemes, invest at least 65% of their assets in equity shares of companies with small market capitalizations. As per SEBI regulations, small-cap equity funds invest primarily in equity or equity-related instruments of small-cap companies. The main objective of these. Small Cap Mutual Funds invest in stocks of smaller companies, offering high growth potential but with increased risk due to market volatility. Learn more.